Welcome to Moneywizard Financial Services, we have over 10 years of expertise

Welcome to Moneywizard Financial Services, we have over 10 years of expertise

What is a mutual fund?

• A Mutual Fund is a trust that pools the savings of a number of investors who share a common financial goal.

• The money thus collected is then invested in capital market instruments such as shares, debentures and other securities.

• The income earned through these investments and the capital appreciation realised are shared by its unit holders in proportion to the number of units owned by them.

• Thus a Mutual Fund is the most suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

Every Mutual Fund is managed by a fund manager, who using his investment management skills and necessary research works ensures much better return than what an investor can manage on his own. The capital appreciation and other incomes earned from these investments are passed on to the investors (also known as unit holders) in proportion of the number of units they own.

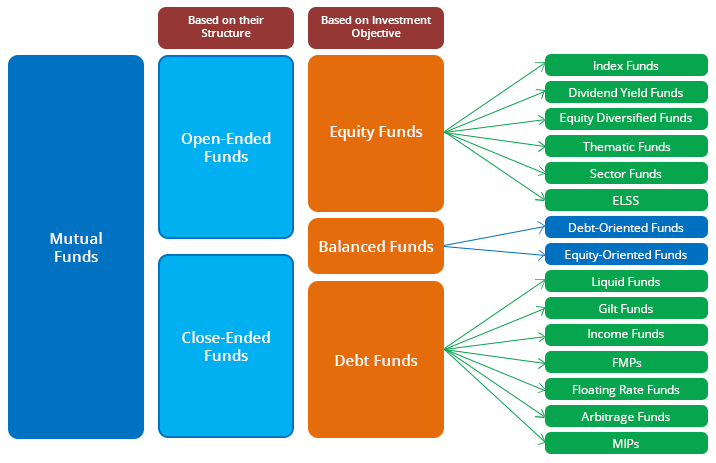

Types of Mutual Funds Schemes in India

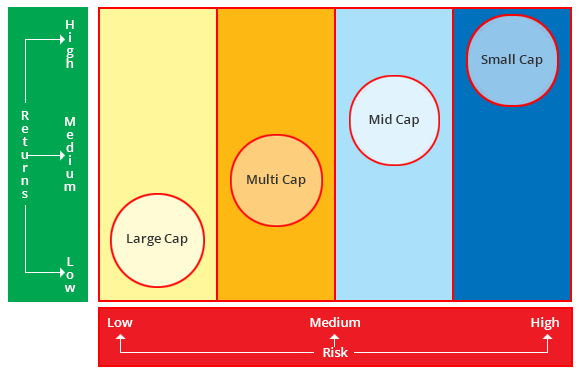

RISK AND RETURN FROM DIFFERENT TYPES OF MUTUAL FUNDS

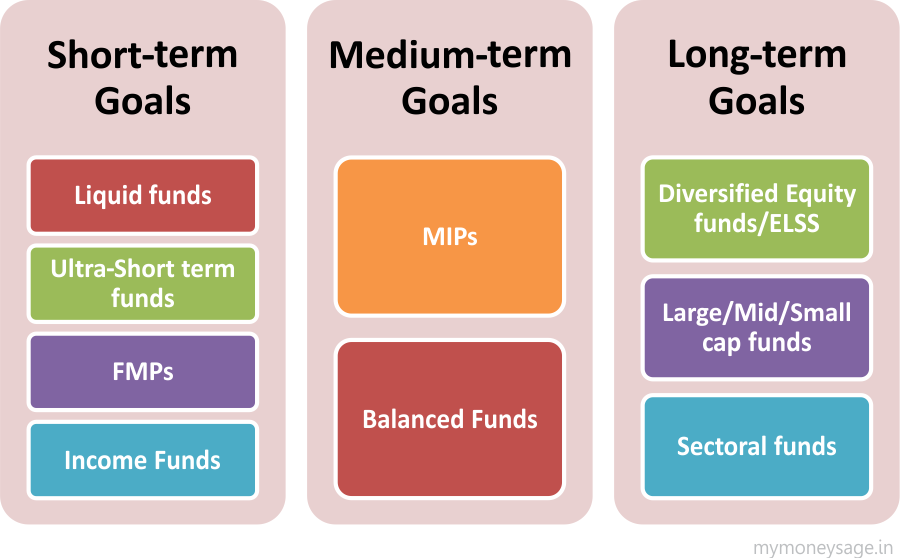

TYPES OF MUTUAL FUNDS SUITABLE FOR GOALS OF VARYING HORIZON

MUTUAL FUNDS-SYSTEMATIC INVESTMENTS, TRANSFERS AND WITHDRAWALS

SIP / STP / SWP

What is SIP / STP / SWP?

Systematic Investment Plan (SIP):

An SIP is a method of investing a fixed sum, on a regular basis, in a mutual fund scheme. It is similar to regular saving schemes like a recurring deposit. An SIP allows one to buy units on a given date each month or quarter, so that one can implement a saving plan for themselves.

Systematic Withdrawal Plan (SWP):

SWP is a smart way to plan for your future needs by withdrawing amounts systematically from your existing portfolio either to reinvest in another portfolio or to meet your expenses. Your savings no longer remain idle. Your money can earn better returns if reinvested, instead of lying idle in a savings account for meeting your regular payments.

Systematic Transfer Plan (STP):

A plan that allows the investor to give a mandate to the fund to periodically and systematically transfer a certain amount from one scheme to another.

Advantages of SIP

Benefits of Systematic Investment Plan

Regular Investment

Systematic Investment Plan is, as the name suggests, regular investment where you invest fixed amounts every month in any of the funds. SIP is a means of investing in a disciplined manner irrespective of the state of the market.

Power of Rupee Cost Averaging

SIP works on the principle of "Rupee Cost Averaging" wherein you invest a fixed amount every month, irrespective of the market movements. In this way, you would buy more units when the market is bearish and take advantage of higher appreciation when the market moves up. Thus, your Average Cost per Unit works out lesser than the Average Price per Unit. Let us look at this more closely through an example.

| Months | Amount Invested (Rs.) | Purchase Price (Rs.) | Units Purchased |

|---|---|---|---|

| 1. | 1,000 | 10 | 100.00 |

| 2. | 1,000 | 9 | 111.11 |

| 3. | 1,000 | 10 | 100.00 |

| 4. | 1,000 | 11 | 90.90 |

| Age at entry | No. of years of investment | Total amount saved (Rs) | Value at age 60 (Rs) |

|---|---|---|---|

| 25 | 35 | 4,20,000 | 23,09,175 |

| 30 | 30 | 3,60,000 | 15,00,295 |

| 35 | 25 | 3,00,000 | 9,57,367 |